capital gains tax rate california

For short-term capital gains in which. The highest rate reaches 133.

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

10 rows This California capital gains tax rate applies to.

. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. These California Capital Gains Tax Rate 2022 are lower than the federal capital gain tax rates which are 0 to 15 and 20 respectively for assets held for longer than one year. These California capital gains tax rates can be lower than the federal capital gains tax rates which are 0 15 and 20 for long-term gains assets held for more than a year.

This means your capital gains taxes will run between 1 up to 133 depending on your overall income and corresponding California tax bracket. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. Capital gains occur on any asset sold for a price higher than the purchase price.

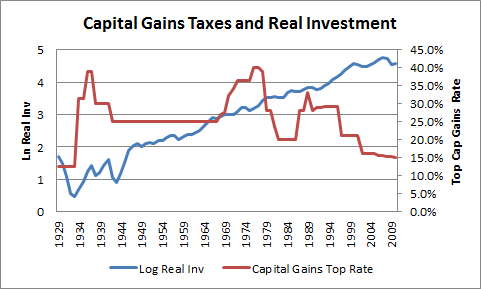

Theyre taxed at lower rates than short-term capital gains. Legislation has been enacted to reverse the temporary 125 percentage point rise in national insurance contributions from 6 November 2022. It also taxes capital gains at the same rate as normal income.

Know what assets are subject to Capital Gains Tax. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of. Taxes capital gains as income and the rate reaches 5.

This is maximum total of 133 percent in California state tax on your capital gains. Taxes on Long-Term Capital Gains. You do not have to report the sale of your home if all of the following apply.

California taxes capital gains as ordinary income. What is California capital gains tax rate on real estate. Long-term capital gains are gains on assets you hold for more than one year.

Your gain from the sale was less than 250000. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. The states with the highest capital gains tax are as follows.

And what is the California short term capital gains for stocks tax rate. In California therefore the tax rate on capital gains for. Stocks bonds mutual funds and real.

California has nine tax brackets. For example a single person with a total short-term capital gain of 15000 would pay 10 of 10275. Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health.

CFP Financial Planner replied 1 day ago An LLC taxed like a. 1 2 4 6 8 93 103. Capital losses occur on any asset sold for a price less than the purchase price.

Just like income tax youll pay a tiered tax rate on your capital gains. What is the California capital gains tax rate for 2019. You have not used the exclusion in the last 2 years.

This is often a surprise to. Taxes capital gains as income and. As for the other states capital gains tax rates are as follows.

This includes stocks bonds mutual funds real estate and personal property. California has no specific capital gains tax rates but imposes the regular California income tax rate on any capital gain. Capital Gains Taxes on Collectibles.

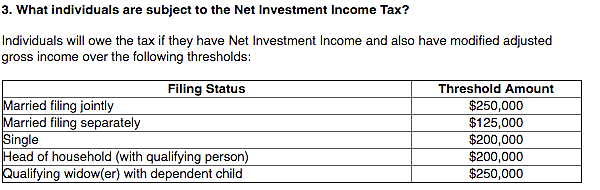

Federal Short-Term Capital Gains Tax Rates Rate Single Married Filing Jointly Married Filing Separately Head of Household 10 0 9950 0 19900 0 9950 0. All taxpayers must report. Understand the difference between short-term.

On that date the rates will drop.

5 Tips To Reduce California Capital Gains Tax Youtube

Capital Gains Tax Archives Skloff Financial Group

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

California State Taxes What You Need To Know Russell Investments

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

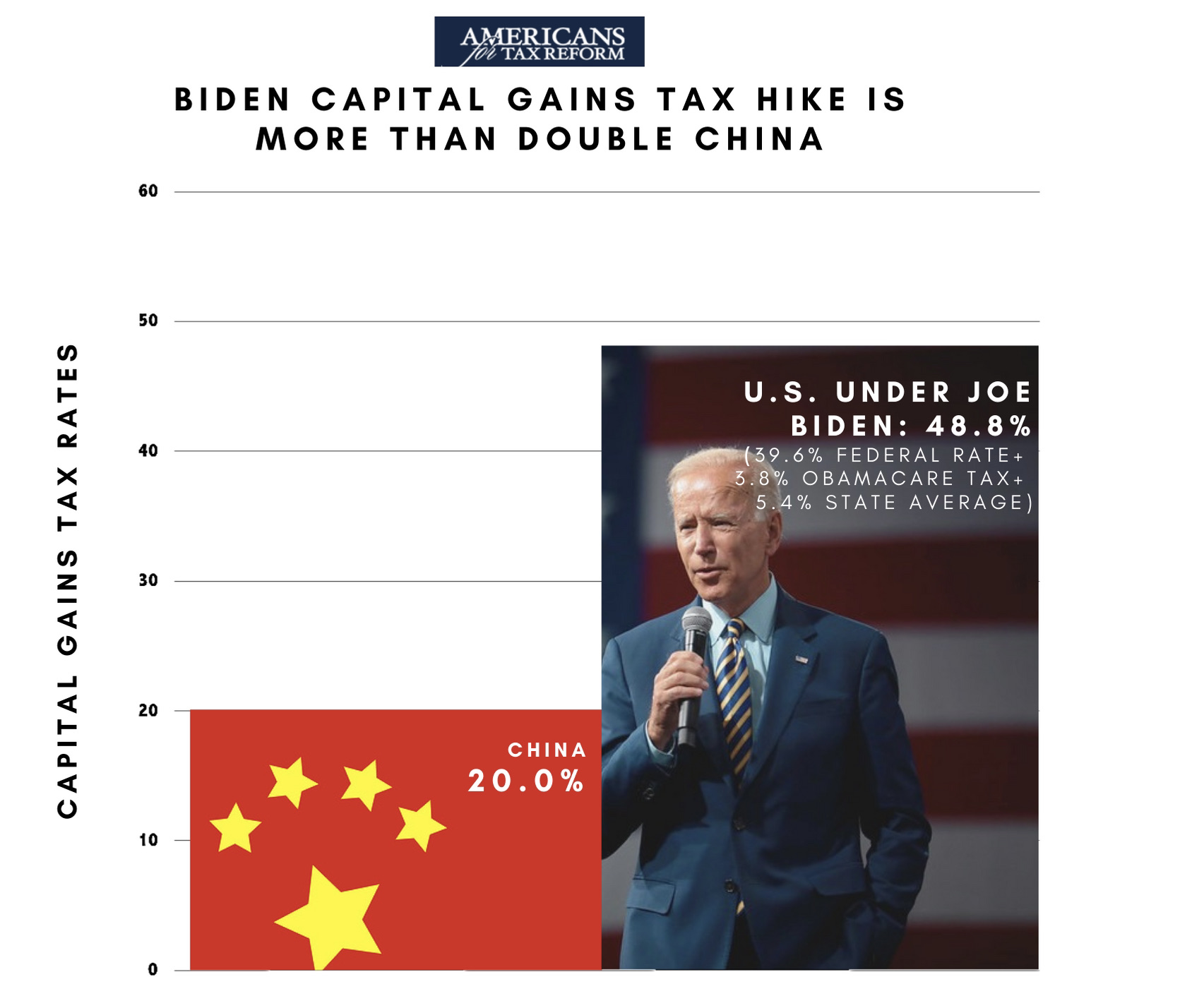

Biden Capital Gains Tax Hike And Corporate Tax Hike Would Leave U S Uncompetitive With China Americans For Tax Reform

What Is The Capital Gains Tax And How Big A Bite Does It Take Los Angeles Times

The Great Capital Gains Charade Mother Jones

Cryptocurrency Tax 101 Intro To Capital Gains And Crypto Tax Treatment By Blockfi Blockfi Medium

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

What Are Capital Gains Taxes For The State Of California

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Taxes On Selling A House In California All You Need To Know

Capital Gains Tax What Is It When Do You Pay It

Combined Capital Gains Tax Rate In California To Hit 56 7 Percent Under Biden Plan